In an effort to ensure greater legal certainty for taxpayers and entrepreneurs with certain gross turnovers (collectively referred to as “Taxpayers”), while simultaneously ensuring that the regulatory framework for income tax (Pajak Penghasilan – “PPh”) deriving from said Taxpayers is in line with the current legal requirements, the Minister has issued Regulation No. 164 of 2023 (“Regulation 164/2023”) on Procedures for the Imposition of Income Tax on Incomes Deriving from Taxpayers with Certain Gross Turnovers and Mandatory Reporting for the Purpose of Being Confirmed as Taxable Entrepreneurs (Pengusaha Kena Pajak – “PKP”), which has been in force since 29 December 2023.

Upon entering into force, Regulation 164/2023 simultaneously repealed and replaced the following legal framework:

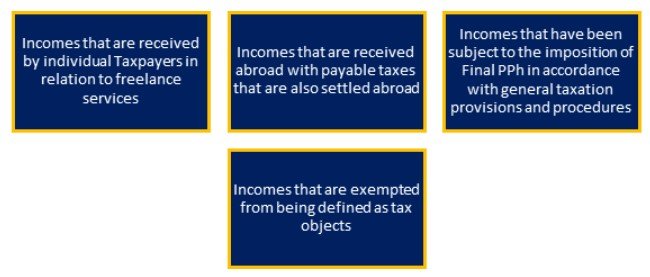

As its title suggests, Regulation 164/2023 covers a wide range of provisions that specifically relate to the imposition of PPh on Taxpayers and reporting obligations for entrepreneurs who wish to be confirmed as PKP, and broadly covers the following aspects:

For reasons of concision, this edition of Indonesian Legal Brief (“ILB”) will confine its discussion to the matters outlined in points (1), (4) and (7) above.

Tax Objects and Taxpayers

At its core, both Regulation 99/2018 and Regulation 164/2023 address incomes that derive from domestic Taxpayers (either individuals or business entities) that are subject to final PPh within certain periods (“Final PPh”). The threshold for said incomes has been set at Rp. 4.8 billion in a given single tax year. However, the latter framework has now clarified that the tariff for said Final PPh has been set at 0.5% of the relevant amount of generated gross turnover.

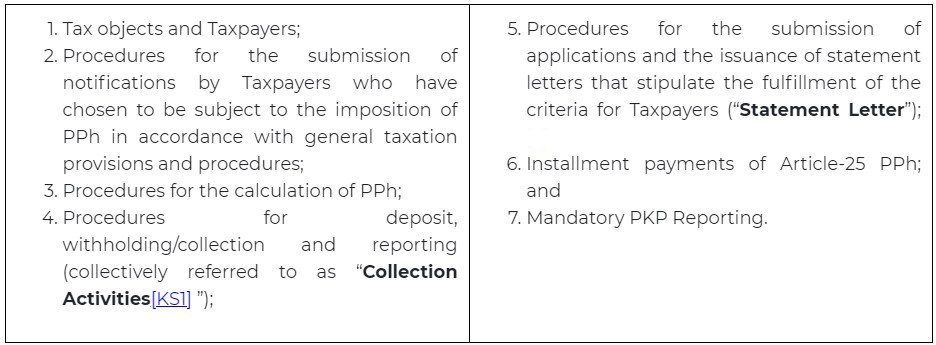

Furthermore, Regulation 164/2023 has introduced no changes in terms of the types of Taxpayers that are now subject to the imposition of the above Final PPh, as originally introduced under the framework of Regulation 99/2018. The latter framework has now clarified which incomes have been exempted from the imposition of said Final PPh, which break down as follows:

Procedures for Collection Activities

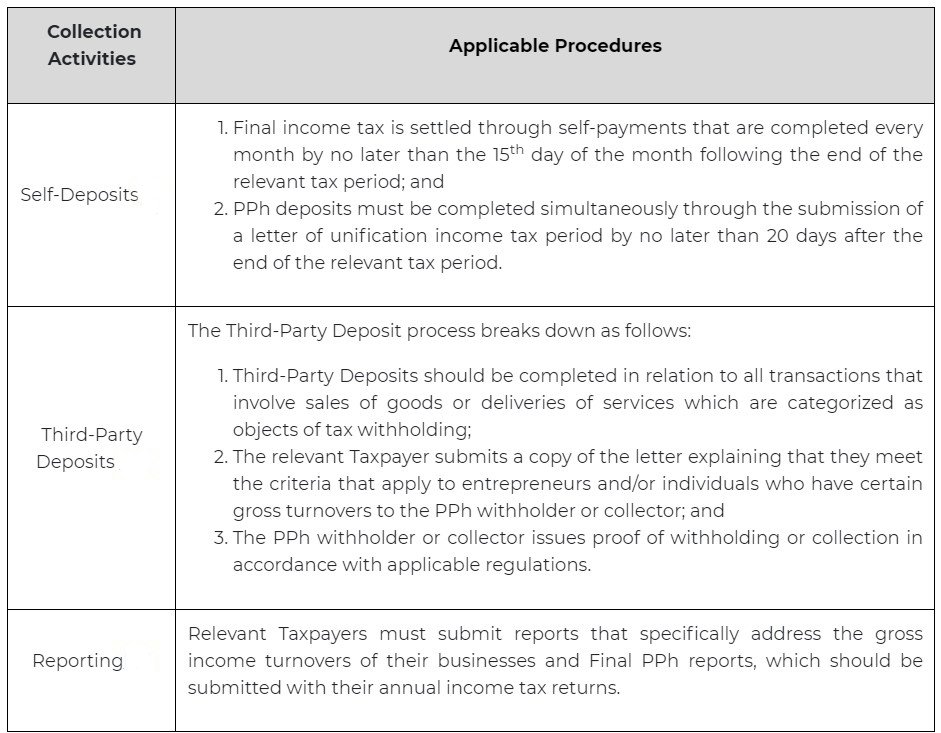

In terms of Collection Activities, Regulation 164/2023 sets out the same applicable procedures that were originally introduced under the framework of Regulation 99/2018 and which state that Final PPh may be settled through either of the following methods:

In this regard, the applicable procedures for the above-mentioned Collection Activities break down as follows:

It should also be noted that Regulation 164/2023 newly states that any Taxpayers who deposit their Final PPh via the Self-Deposit method are required to submit unified PPh periodic tax returns (“Unified Tax Returns”) by no later than 20 days after the end of a given tax period. However, any incomes that have not exceeded Rp. 500 million based on the total gross turnover since the initial tax period will be exempted from the Unified Tax Return requirements. Moreover, any sales or services that are provided through individual Taxpayer deposits via Third-Party Deposits that do not exceed Rp. 500 million will also be exempted from Final PPh withholding/collection.

Mandatory PKP Reporting

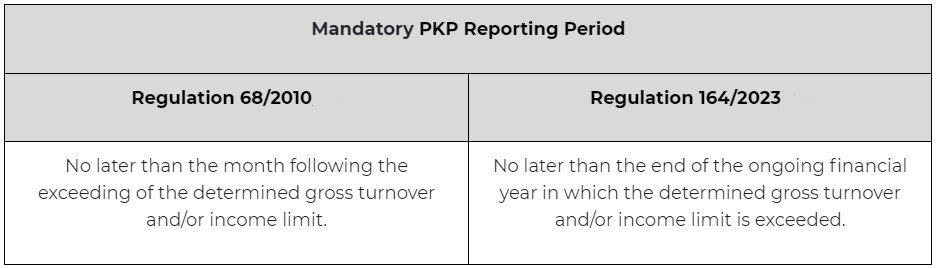

While retaining the Mandatory PKP Reporting requirements originally introduced under Regulation 68/2010, which are mandatory in relation to any determined gross turnovers and/or income limits that apply to small entrepreneurs that are exceeded during a one-month period of the ongoing financial year, the new framework of Regulation 164/2023 has now adjusted the report submission period. However, the above gross turnover and/or income limit threshold has been set at Rp. 4.8 billion, as Regulation 164/2023 adheres to the limit that was originally set under Regulation 68/2010.

The above-described adjusted Mandatory PKP Reporting submission period breaks down as follows:

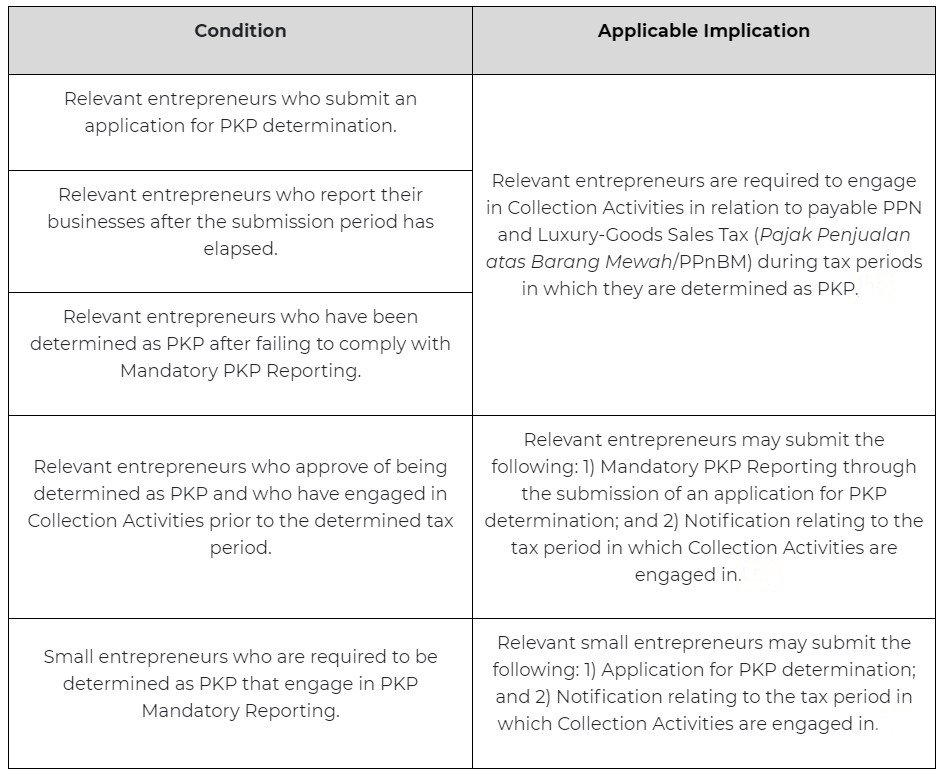

It should also be noted that any failure to comply with the above-described Mandatory PKP Reporting will result in a PKP determination, as made by the head of the relevant tax office. In addition, Regulation 164/2023 has also introduced a number of conditional provisions that relate to the aforementioned Mandatory PKP Reporting, as summarized in the table below:

Source : hukumonline.com

Jl. H. R. Rasuna Said Blok X-5 No.Kav. 2-3, Kuningan, Jakarta 12950

National Economy

Regional Economy