Earlier this year (2023), the government issued Law No. 4 of 2023 on the Development and Strengthening of the Financial Sector (“Law 4/2023”), which aims to reform the Indonesian financial sector through collaborative and interconnected efforts that are undertaken between actors operating within the financial sector and the financial services industry. In order to fulfill the mandates set out under Law 4/2023, the Financial Services Authority (Otoritas Jasa Keuangan – “OJK”) is now aiming to regulate the development and strengthening of microfinance institutions (Lembaga Keuangan Mikro – “LKM”) through the issuance of a new Draft Regulation, for which the public examination stage was concluded on 27 October 2023.

At its core, the Draft Regulation covers a broad range of provisions that specifically relate to LKM, which were previously regulated under a number of different OJK legal frameworks. Accordingly, the promulgation of the Draft Regulation will simultaneously repeal and replace the following regulations:

Despite the forthcoming revocation of the above-listed regulations, it should be noted that any administrative sanctions that have already been issued on the basis of any of the above-listed regulations will remain effective.

The Draft Regulation consists of five books that have been divided into a total of 113 articles. In this edition of Indonesian Law Digest, Hukumonline will discuss the various provisions set out under the Draft Regulation by emphasizing the newly applicable requirements and obligations, along with a comparative analysis that addresses the previously applicable regulations. In order to ensure a thorough and concise discussion of these matters, our analysis has been broken down into the following sections:

Generally speaking, the Draft Regulation makes no significant changes to the business licensing requirements that were previously set out under the framework of Regulation 10/2021. In this regard, LKM must be legal entities that take the form of cooperatives or limited-liability companies and cannot be owned by parties other than: 1) Indonesian nationals; 2) Village-owned enterprises; 3) Regionally-owned enterprises at the regency/city/provincial level; and/or 4) Cooperatives.

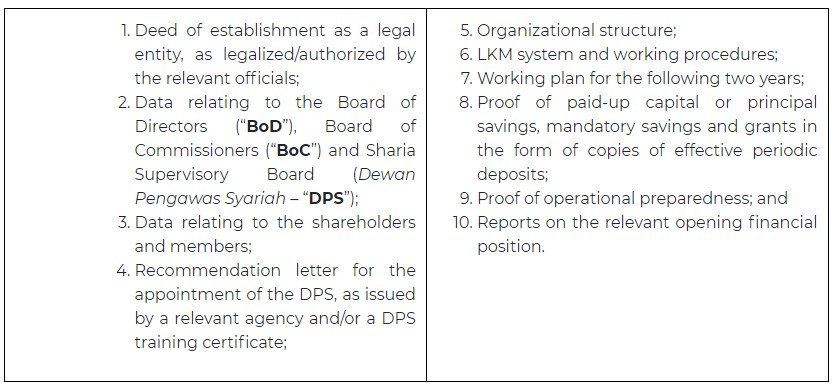

LKM must secure business licenses from the OJK prior to engaging in any business activities by submitting business license applications in accordance with Format 1, which can be found set out under the Appendix to the Draft Regulation, along with the following supporting documents:

Once an application has been completed and received by the OJK, then the OJK will subsequently issue an approval or rejection in relation to the submission within a maximum of 20 business days of the relevant application being received. In comparison with the previous framework of Regulation 10/2021, the Draft Regulation now states that incubated LKM may submit requests for business licenses as LKM with non-cash capital payments. However, LKM that are established for the purpose of government programs or that are established by non-profit communities, or LKM that have yet to be able to fulfill the basic requirements are also permitted to submit LKM license applications using Format 2, as set out under the Appendix to the Draft Regulation.

LKM that ultimately secure business licenses from the OJK must commence their business operations within four months of the issuance of said business licenses. Furthermore, LKM must also submit reports that specifically address the implementation of business activities within 20 business days of the commencement of their business activities.

While the overall provisions that specifically address institutional aspects of LKM have not been revised, the Draft Regulation introduces a new set of provisions on the development of human resources and which must be fulfilled by LKM. In this regard, LKM will be required to organize programs that specifically address the development of the skills and knowledge of their human resources. Said programs should be organized on an annual basis by LKM and should encompass educational and training programs.

In order to ensure the adequate fulfillment of said programs, LKM are also obliged to allocate and realize a minimum of 2.5% percent of their human resources budgets for the implementation of skills and knowledge development programs.

In addition to the various obligations that relate to the development of human resources, the Draft Regulation has also adjusted the various requirements that apply to BoD. As previously regulated under Regulation 10/2021, the Draft Regulation now reaffirms that any LKM that take the form of legal entities and that engage in activities that encompass the collection of savings must have at least two BoD members and two BoC members. Furthermore, any LKM that are categorized as large-scale businesses must also have the following members as a part of their institutional composition:

LKM must bring their operations into line with the newly introduced obligations outlined above within three years of the promulgation of the Draft Regulation. Meanwhile, any failure to comply with said obligations will result in the issuance of a notification letter to the LKM that will remain effective for a period of 40 business days before administrative sanctions are ultimately imposed. The following applicable administrative sanctions will be available:

In comparison with the administrative sanctions previously set out under the framework of Regulation 10/2021, the sanctions set out under points (2) and (4) above have been newly introduced under the Draft Regulation.

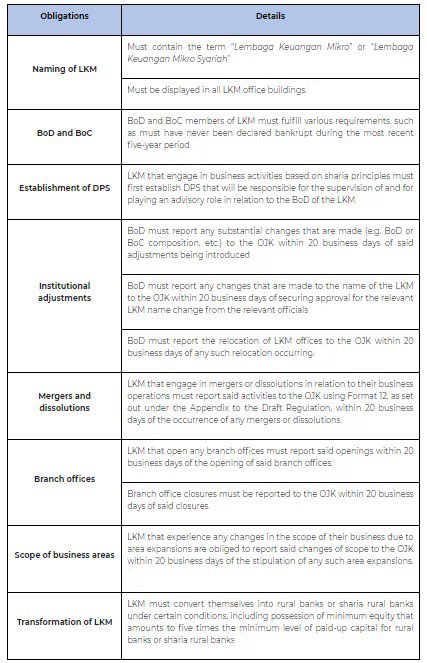

In addition to the various major adjustments outlined above, no other adjustments have been set out under the Draft Regulation that specifically relate to business licensing or institutional aspects. Nevertheless, it is important for LKM to remain aware of the various obligations that they must comply with. The table below summarizes the relevant obligations that are set out under the Draft Regulation, which in general reaffirms the obligations that are set out under the previous legal frameworks:

Any failure to comply with any of the above-described obligations will result in the issuance of a notification letter to the LKM, which will remain effective for a period of 40 business days prior to the imposition of any of a range of available administrative sanctions.

In terms of the various aspects of business activities, the Draft Regulation has made no significant revisions to Regulation 19/2021 and still encompasses the following scope of activities:

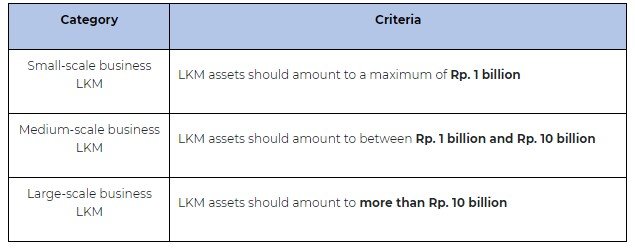

However, the Draft Regulation has now introduced two new categories of LKM, which are based on the scale of LKM business activities. The newly introduced categories are summarized in the table below, along with the criteria that apply to each category:

The OJK will stipulate the relevant scales and categories of LKM based on their assets, as calculated from their regular financial reports, as submitted during the last year. In cases where LKM secured their business licenses less than three months ago, the relevant assets will be calculated based on the financial reports that they submitted along with their applications for said business licenses.

Furthermore, the various scale categories that LKM fall into may also be changed, depending on the fluctuation of their assets, as demonstrated through financial reports that are submitted during the course of a given year or based on certain OJK considerations.

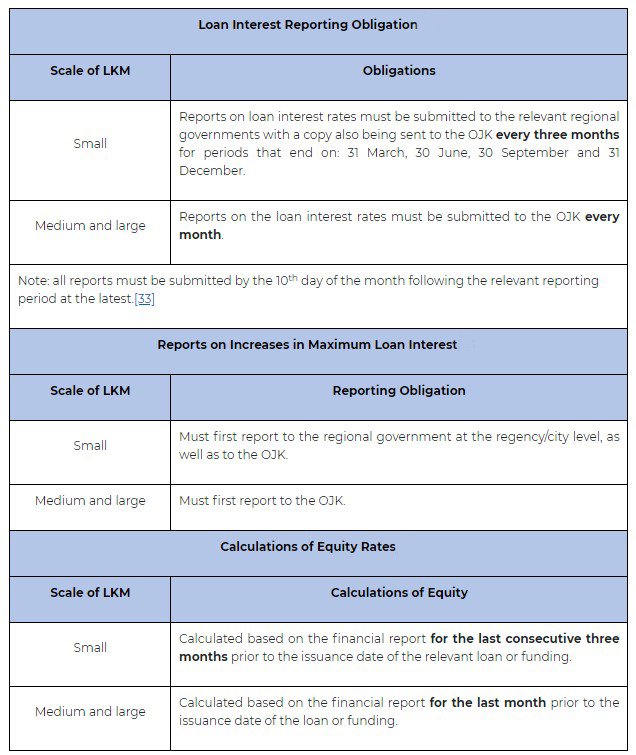

Due to the newly introduced categorization of LKM assets, the Draft Regulation has also made a number of adjustments to certain provisions that relate to the organization of LKM, specifically the issuance of loans or funding, along with the relevant corresponding reporting obligations that relate to said activities. Said adjustments are summarized in the table below:

Accordingly, once the Draft Regulation has been promulgated, LKM should then begin to organize their business activities in accordance with their business scale categories, as outlined above.

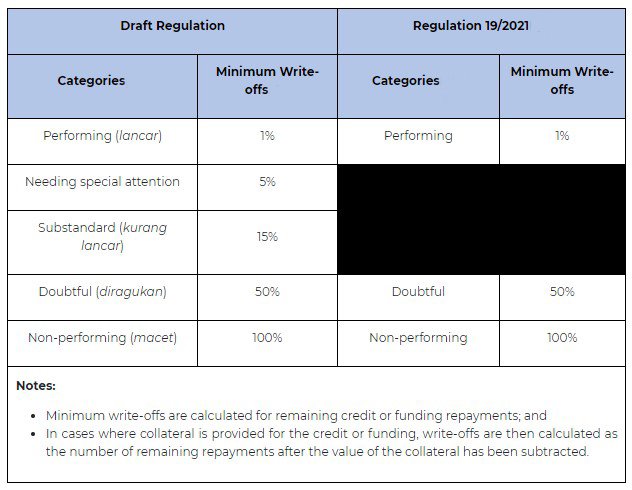

During the performance of their regular business activities, LKM are obliged to complete evaluations of the quality of all credits or funding that have been issued. The Draft Regulation classifies the results of said evaluations into five categories, which is a notable adjustment, as Regulation 19/2021 previously only featured three categories. This adjustment also affects certain provisions that relate to the obligation of LKM to provide write-offs (“Write-off Obligation”). A comparison between said category adjustments of categories along with the required Write-off Obligations is set out in the table below:

In terms of credit or funding with collateral specifically, it should be noted that LKM are obliged to perform evaluations of said collateral in order to ensure its economic value and must possess facilities that meet the minimum safety and security requirements for the storage of collateral.

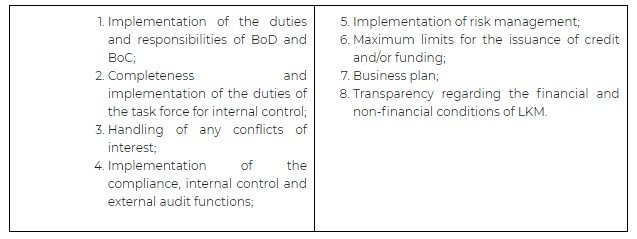

Under the Draft Regulation, LKM that operate medium- and large-scale businesses are obliged to prepare and submit annual business plan reports that have been approved by their BoC. The scope of submitted business plans should encompass the following elements at the least:

Business plans must be submitted by 30 November prior to the new business year at the latest. Further provisions that address the submission of business plans by LKM will feature under a forthcoming Regulation of the OJK.

In addition, LKM will also be subject to the obligation to implement good corporate governance through the implementation of the principles of transparency, accountability, responsibility, independence and reasonableness. Said implementation of principles breaks down as follows:

Within the more specific context of obligations, LKM with large-scale business operations must submit annual reports on the implementation of good corporate governance at the end of every year, as will be further regulated by the OJK.

The Draft Regulation has also now introduced the mandatory implementation of effective risk management, which should be implemented in accordance with the objectives, policies, scale and complexity of businesses that operate through LKM. Risk management should be performed in relation to the following types of risks at the least: strategic, operational, credit, market and liquidity.

At the minimum, the implementation of risk management should be carried out through active monitoring, as undertaken by BoD, BoC and DPS, and in line with risk management procedures and policies; the stipulation of risk limits; adequate processes of identification, measurement, control and monitoring; and through the use of risk management information systems and internal controls.

Within the more specific context of obligations, LKM that operate large-scale businesses must submit annual reports on the implementation of risk management.

Finally, LKM will also be bound by the obligation to prepare and implement effective anti-fraud strategies, which should comprise four pillars, specifically: 1) Identification; 2) Detection; 3) Investigation, reporting and sanctions; and 4) Monitoring, evaluations and follow-up measures. The effective implementation of anti-fraud strategies must be ensured by the BoC and/or BoD of the relevant LKM.

While all of the above-listed regulations that apply within this sector must be implemented by LKM within three years of the Draft Regulation being promulgated, it should also be noted that LKM are required to submit their anti-fraud strategies to the OJK within six months of the Draft Regulation being promulgated.

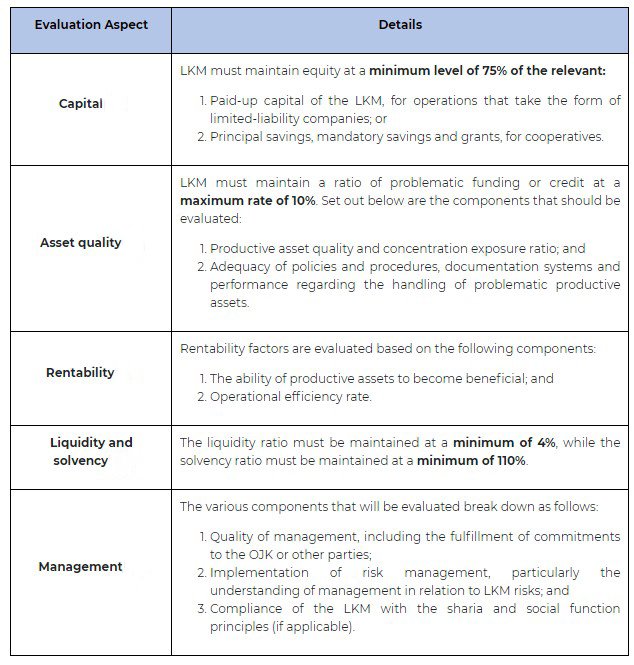

LKM are required to maintain and/or increase their soundness levels through the implementation of the prudential principles, as well as the performance of risk management during their business activities. Evaluations of soundness levels are dependent on several aspects, including the relevant levels of capital, asset quality, rentability, liquidity and solvency, and management.

Details of each of the above-listed aspects of soundness level evaluations are summarized in the table below:

In cases where LKM fail to comply with the obligation to maintain the required soundness level, then the OJK and the regional governments will have the authority to request that:

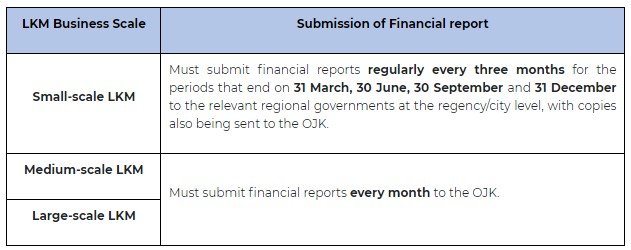

LKM are obliged to prepare and submit financial reports in accordance with the applicable financial accounting standards. However, as a result of the introduction of the new LKM categories that are based on their business scales, the provisions that relate to the submission of financial reports have also now been adjusted.

The various provisions that address the submission of the financial reports, as featured under the Draft Regulation, are summarized in the table below:

The submission deadline for all financial reports is the 10th day of the month following the relevant reporting period. Furthermore, medium-scale LKM with total assets that amount to a minimum of Rp. 10 billion must submit annual financial reports, as audited by a public accountant, to the OJK within five months of the end of the financial year.

In addition, LKM must also announce their financial positions and income statements for every one-year period via announcement boards that are located in LKM offices or via local newspapers within five months of the end of the financial year. Any failure to comply with these reporting obligations will result in the imposition of administrative sanctions.

The Draft Regulation contains a comprehensive set of provisions and combines several legal frameworks into a single instrument. Moreover, the Draft Regulation represents a comprehensive and stringent regulatory framework that seeks to enhance the governance, soundness and operational transparency of LKM. In addition, the new framework underscores the need for LKM to adapt to the new asset-based categorization system, prepare for increased reporting obligations and prioritize good corporate governance, risk management and anti-fraud measures. Compliance with these regulations will be vital for the long-term viability and success of LKM within Indonesia’s evolving financial landscape.

Source : hukumonline.com

Jl. H. R. Rasuna Said Blok X-5 No.Kav. 2-3, Kuningan, Jakarta 12950

National Economy

Regional Economy