Among the various aspects that were originally outlined under Regulation of the President No. 55 of 2019 on the Acceleration of the Battery-Powered, Electric Motor Vehicles for Road Transportation Program, as amended by Regulation of the President No. 79 of 2023 (collectively referred to as “Regulation 55/2019”), it was mandated that importers of four-wheeled, battery-powered electric vehicles (“BEV”) would be able to enjoy incentives that take the form of subsidized import duties and luxury-goods sales tax (Pajak Penjualan atas Barang Mewah – “PPnBM”).

In line with the mandate set under the above-mentioned framework of Regulation 55/2019, the Minister of Investment/Head of the Investment Coordinating Board (Badan Koordinasi Penanaman Modal/BKPM) (“Minister”) has now issued Regulation No. 6 of 2023 on Guidelines for and the Governance of the Provision of Incentives for Imports and/or Deliveries of Four-Wheeled, Battery-Based Electric Motor Vehicles in Order to Accelerate Investment (“Regulation 6/2023”), which has been in force since 13 January 2024.

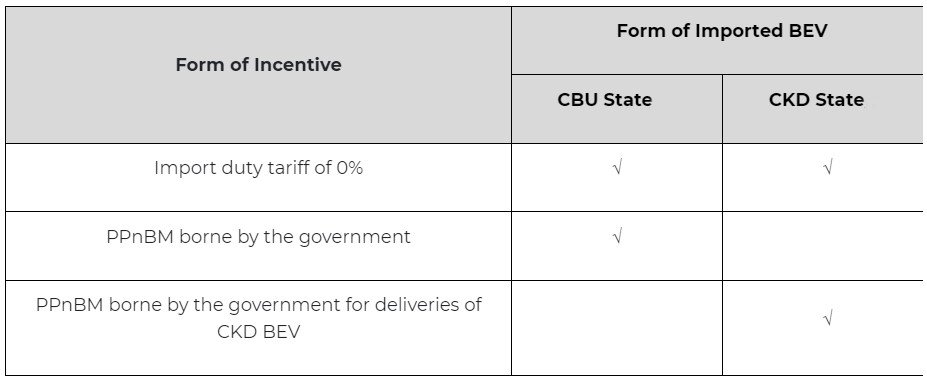

At its core, business actors that engage in BEV manufacturing industries (“Business Actors”) are eligible to secure incentives for the importation of BEV (“Incentives”), either in a completely built-up (“CBU”) or completely knocked-down (“CKD”) state. The latter import state requires the relevant vehicles to ultimately be assembled in Indonesia with achieved Domestic Component Levels (Tingkat Komponen Dalam Negeri – “TKDN”) of between 20% and 40%. Details of the available Incentives break down as follows:

Given the importance of the above-outlined Incentives, particularly for Business Actors that wish to import BEV, this edition of Indonesian Legal Brief (“ILB”) offers a summary of the applicable procedures for the granting of Incentives that have now been introduced under the new framework of Regulation 6/2023, specifically as they relate to the following matters:

Granting of Incentives: Applicable Criteria and Import/Delivery Thresholds

Regulation 6/2023 introduces an applicable Incentive utilization period of 29 December 2023 until 31 December 2025. Furthermore, in order to secure Incentives, relevant Business Actors must comprise industrial companies that meet one of the following investment criteria:

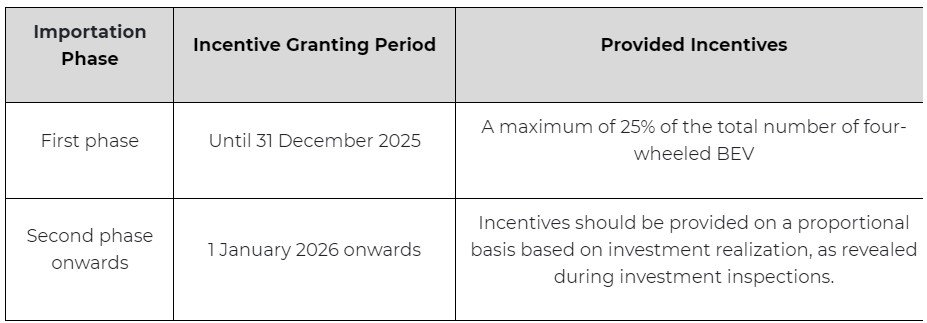

It should also be noted that if Incentives are ultimately secured, then Regulation 6/2023 sets thresholds that apply in relation to the importation and/or delivery of BEV and these thresholds will be ultimately outlined in approvals for Incentive utilization (“Incentive Approvals”). Said thresholds break down as follows:

Submission of Incentive Applications

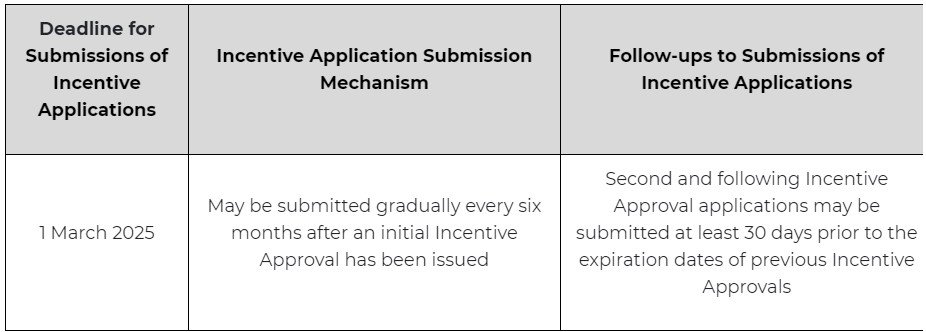

In terms of the securing of Incentives themselves, relevant Business Actors should submit applications for the granting of Incentive proposals (“Incentive Proposals”) and Incentive Approvals through the Online Single Submission (OSS) system. However, Regulation 6/2023 states that Incentives that are granted based on Incentive Approvals should be implemented in accordance with the following terms:

Moreover, Incentive Proposals should be submitted along with the following required documents:

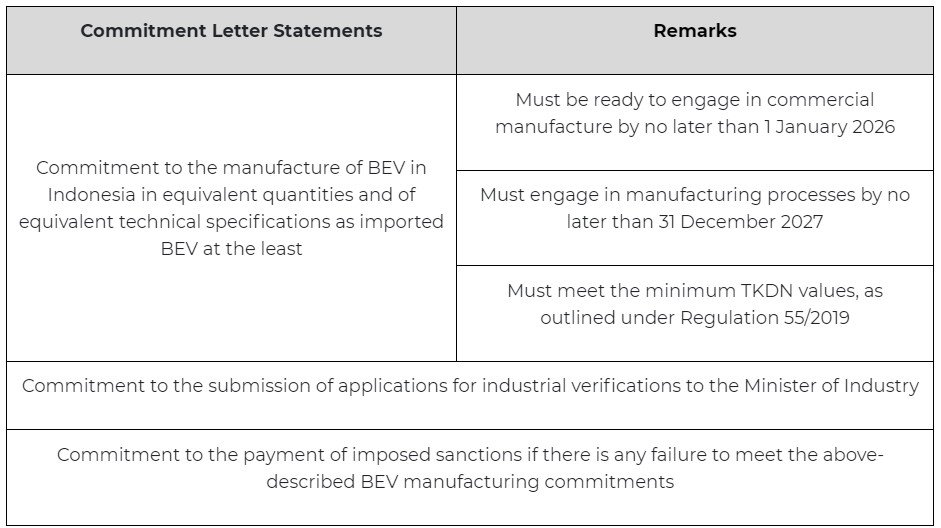

In terms of the above-mentioned commitment letter, Regulation 6/2023 states that said letter should contain the following statements:

If an Incentive Proposal is ultimately issued, then the relevant Business Actor may proceed to submit an application for an Incentive Approval through the submission of commitment collateral that takes the form of bank guarantees (“Guarantees”). In this regard, Regulation 6/2023 states that said Guarantees must comply with various aspects, including:

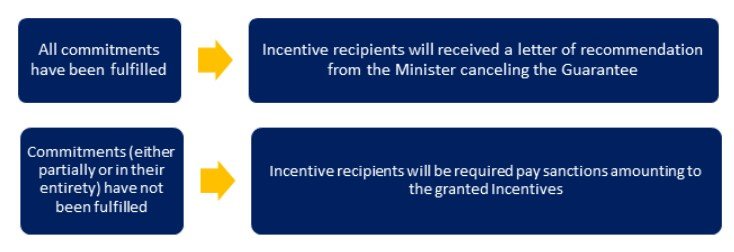

Given that the Minister is authorized to periodically supervise Incentive recipients in relation to granted Incentives, it is important to note that the following implications will result from any compliance or non-compliance with established commitments:

Jl. H. R. Rasuna Said Blok X-5 No.Kav. 2-3, Kuningan, Jakarta 12950

National Economy

Regional Economy